Ahir, 19 d’octubre de 2021, es va realitzar la conferència “A path to effective climate policy: Implications for Spain and Catalonia”, a càrrec del Sr. Jeroen van den Bergh, professor de recerca ICREA (Institució Catalana de Recerca i Estudis Avançats) a l’Institut de Ciència i Tecnologia Ambientals (ICTA) de la Universitat Autònoma de Barcelona des del 2007 i catedràtic d’Economia Ambiental de la Universitat Lliure d’Amsterdam des del 1997. A continuació es pot trobar un resum de la conferència, realitzat pel mateix Sr. Jeroen van den Bergh:

Summary

Summary

My lecture assesses insights and evidence from theoretical and empirical studies on how effective climate policy is best designed. It is elaborately argued why a central role should be assigned to the instrument of carbon pricing, giving attention to both classical arguments and additional ones that may entice a broader audience. Essential is that – unlike any other instrument – carbon pricing has a systemic character: it changes the relative prices of all low- and high-carbon inputs, intermediate and final goods, thus affecting all decisions by producers, investors, innovators and consumers. This in turn will cover all relevant emissions and minimizes indirect energy/carbon rebound effects (e.g., in production chains), which can seriously reduce the overall effectiveness of climate policy. In addition, through it complete emissions coverage and selection of affordable reduction options, carbon pricing will assure that the transition to a low-carbon economy is rather smooth and with minimal economic or unemployment costs. Regarding climate justice, through wise use of its revenues carbon pricing becomes the most equitable policy instrument. Incidentally, it is insufficiently recognized that an instrument like adoption subsidies tends to perform worse in terms of equity – e.g., subsidies for electric vehicles and rooftop solar PV generally end up in the pockets of well-off households.

Another overlooked issue is that carbon pricing, notably carbon markets, offer the best chance to harmonize policy among countries. Witness the EU-ETS (emissions trading system) which covers 31 countries. International harmonization is required for gradually strengthening climate policy without politicians having to fear negative competitive effects for their national economies. Indeed, unilateral policy, still the default practice given that the Paris agreement did not achieve policy harmonization, has remained weak due to such political fears. To create more potential for international harmonization of national climate policy one should limit the complexity of policy packages and develop them best around carbon markets gradually extended to all sectors.

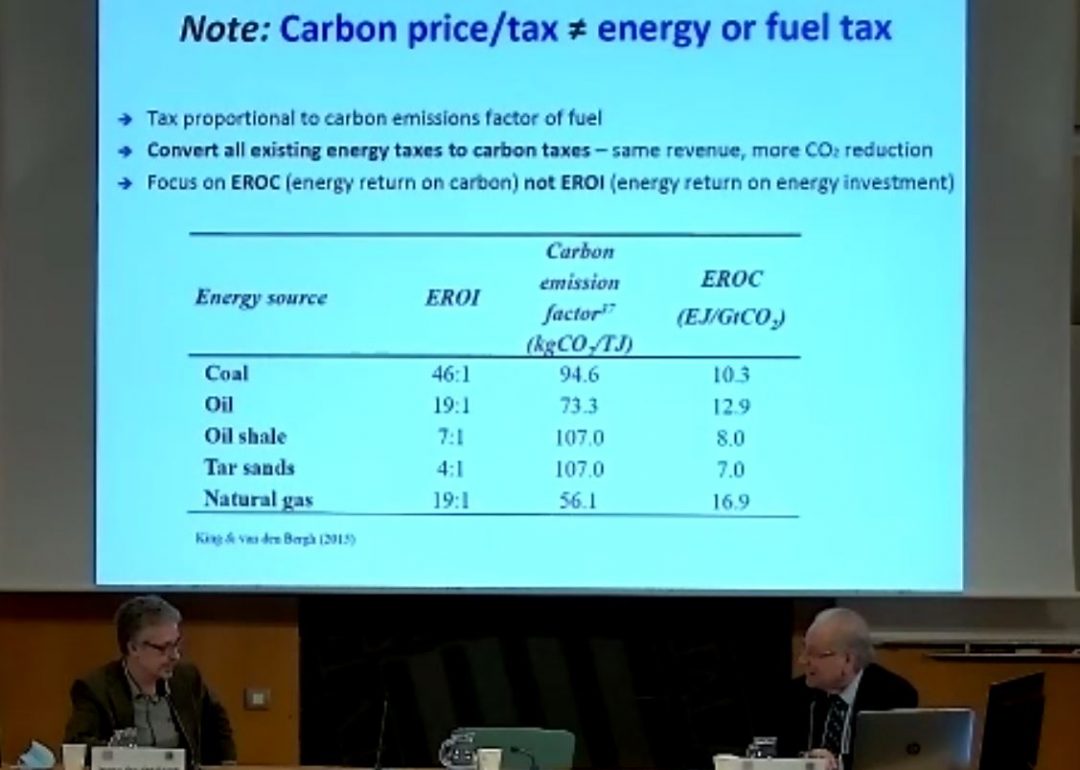

Incidentally, it should be noted that a carbon price is not the same as an energy or fuel tax. The latter is not designed to be proportional to the carbon content of fuels. In fact, all governments should quickly transform existing energy and fuel taxes into genuine carbon pricing to maximally benefit from the more precise incentive of these to reduce carbon emissions – and without altering overall tax revenues much.

Climate policy must be broader than carbon pricing. Main complementary instruments include technical standards (e.g., car engine capacity and performance), innovation support, and information provision (and/or nudges). Policy mixes should be designed to avoid negative and employ positive synergies. For example, combining targets, such as renewable-energy quota, with a carbon market can produce negative synergy, up to the point of adding no emissions reduction beyond the cap, while raising overall costs of emissions reduction. Positive synergy is illustrated by provision of social information – with low stand-alone effectiveness (around 5-10%) according to reviews and meta-analyses – combined with pricing or regulation: the latter changes choices by a subset of the population to low-carbon, while information provision then improves social imitation of the observed low-carbon choices by others, resulting in a social multiplier effect.

Although some social scientists will never become enthusiastic supporters of carbon pricing, it would be useful if they informed themselves and recognized the immense potential it offers for emissions reduction. The lecture provides an account of the main pro- and contra-arguments, noting that there is now ample empirical evidence for the effectiveness of carbon pricing, in terms of both direct emissions reduction and low-carbon innovation. In fact, one should expect that carbon pricing will pave the way for deep decarbonization, not only because it affects all decisions by all economic agents on demand and supply sides, so that nothings escapes its influence, but also as one can easily imagine that there is a critical value of a carbon price that will induce a social tipping point to a low-carbon economy.

Regarding Spain, I consider three levels: state, Catalonia and Barcelona (because of its relative importance to the Catalan and even the Spanish economy). While especially at the Spanish state and Barcelona levels there are a lot of measures and strategies available, my overall judgment is that these represent rather ineffective means of reducing emissions. This is not surprising, as many policies take either the form of soft and enabling measures (e.g., requiring electric vehicle (EV) charging stations, urban renewal, and corporate climate plans) or future bans (on combustion engines and fossil-fuel production after 2040/42). More effective regulatory and pricing instruments to assure a gradual transition to low-carbon practices are lacking. The current state policy regarding electricity markets shows limited understanding of causes and precise inequity effects. It would be recommendable (i.e. more effective, cheaper and equitable) to lower income taxes for energy-poor households instead of (temporarily) removing VAT and other taxes on electricity prices for all (poor and rich) electricity users.

Spain’s main instrument of climate policy, subsidizing EVs, is bound to have little effect on emissions reduction, due to energy/carbon rebound (EV will be used more intensively) and electricity being on average still high-carbon in Spain (and for a considerable time to come). Regarding the main Catalan policy, the (quasi-)CO2 tax (quasi as it is a misleading term) on vehicles with high-emission engines is also bound to be ineffective as it is unrelated to annual kilometrage of cars and the carbon content of fuel use (unlike a genuine carbon tax). Regarding Barcelona, its main role is adaptation to climate change, while it can do more to reduce ownership of cars. However, regulation of production sectors, including carbon pricing, are on the plate of the Spanish state, as this will assure maximum emissions coverage and minimizing leakage among regions.

In conclusion, the current policy design at the three considered governance levels in Spain shows little appreciation for effective policies with systemic coverage. Policymakers would do good to rely more on the advice from academic experts on implementing effective, evidence-based policies. It might help to explicitly limit the number of climate policy instruments as the current long lists of mostly ineffective instruments could be easily interpreted as a case of greenwashing, or at best as an excuse to top up one after another ineffective instrument in the vague hope that this sums up to an effective policy mix. Without effective and stringent instruments, Spain’s climate policy may fail to reach its – within EU context unambitious – 2030 goal of 23% emissions reduction.

References

(in Spanish language)

Drews, S., and J. van den Bergh (2021). Efectos y limitaciones del impuesto cuasi-CO2 a coches en Cataluña. Nada es Gratis 26/7/2021

Drews, S., J. van den Bergh and S. Maestre (2019). ¿Aceptaríamos en España un impuesto al carbono? The Conversation 25/6/2019.

van den Bergh, J. (2019). Más allá del Acuerdo de París para revertir el aumento de emisiones CO2. El Periódico 25/11/2019.

van den Bergh, J. (2016). París, un acuerdo débil para afrontar el cambio climático. El País 25/4/2016.

van den Bergh, J. (2015). Cómo evitar las tres ‘vías de escape’ de estrategias climáticas. La Vanguardia 22/5/2015.

(in English)

Baranzini, A., J. van den Bergh, S. Carattini, R. Howard, E. Padilla, J. Roca (2017). Carbon pricing in climate policy: Seven reasons, complementary instruments & political-economy considerations WIREs Climate Change 8(4), e462.

Konc, T., I. Savin and J. van den Bergh (2021). The social multiplier of environmental policy: Application to carbon taxation. Journal of Environmental Economics and Management 105, 102396.

van den Bergh. J. et al. (2020). A dual-track transition to global carbon pricing. Climate Policy 20(9): 1057-69.

van den Bergh, J., Castro, J., S. Drews, F. Exadaktylos, J. Foramitti, F. Klein, T. Konc and I. Savin (2021). Designing an effective climate-policy mix: Accounting for instrument synergy. Climate Policy 21(6): 745-764.

van den Bergh, J. (2020). Systemic assessment of urban climate policies worldwide: Decomposing effectiveness into 3 factors. Environmental Science and Policy 114: 35-42.